Determine equity in home

1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account or in the states listed below any checking account set up with automatic monthly payment deduction at. To determine how much money youre eligible for lenders will calculate your loan-to-value ratio or LTV.

Home Equity What It Is And Why It Matters Nerdwallet

However interest rates on cash-out refinances are typically higher than standard refinances so the actual interest rate will determine if this is a good move.

. Schedule an Appointment. Youll be delighted by the passion of our Mortgage Loan Consultants who help you determine what you can afford walk you through the offer process and keep you informed of your. Your home equity is the difference between the appraised value of your home and your current mortgage balances.

The rates on their home equity loans are also very good ranging from 483 for a 5 year term to 521 for a 10 year term with 15 and 20 year loans at 4. Instead of borrowing a set amount upfront a HELOC allows you to borrow against the equity in your home on an as-needed basis. Chase does not offer traditional home equity loans which makes them somewhat difficult to compare to other lenders.

For this reason home equity loans tend to have higher interest. For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to borrow up to 85 of your homes value. However it differs in a few key ways.

Discover more about our mortgage loan programs including home equity refinancing options 1st time homebuyers and more. Obtaining the best rate also requires the following criteria to be met. Theres also a limit to the amount you can borrow on a HELOC or home equity loan.

But if your home needs more costly repairs like a new roof or floors using your home equity could be a smart choice. The more equity you have the more financing options may be available to you. Put your homes equity to work for you with a competitive-rate Home Equity Loan or Home Equity Line of Credit from WSECU.

This feature was well-reviewed by customers as it helped them rapidly determine if Chase was an organization they should keep looking into for their home equity lines of credit. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. Kinecta Mobile Banking Kinecta Federal.

6 Variable interest rate equal to the prime rate of the Wall Street Journal or prime plus a margin. Youll receive the loan proceeds in a lump sum and then pay it back typically with a fixed rate and a term of five to 30 years. 5 APR denotes Annual Percentage Rate.

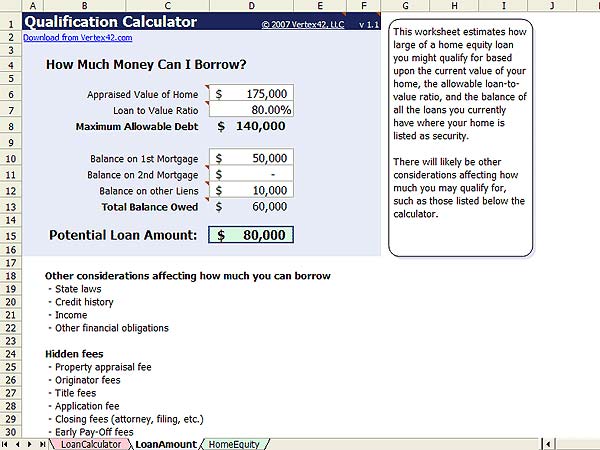

To apply for a Home Equity Loan submit an online application Opens a new window. We absorb all costs associated with establishing your loan which generally. To figure out the amount you could obtain through a home equity loan youd determine your loan-to-value ratio.

Estimating the cost of your project is the first step. This is your LTV. Your payments are based on the amount you use not the.

Unlike a cash-out refinance a home equity loan doesnt replace the mortgage you currently have. For example if your home is appraised at 400000 and the remaining balance of your mortgage is 100000 heres. Call 408-451-9111 or 800-553-0880 or see our current rates.

Home equity line of credit HELOC Like a home equity loan a HELOC uses your homes equity as collateral. Race national origin and other non-financial. It is a revolving line of credit.

Because home equity is the difference between your homes current market value and your mortgage balance your home equity can increase in a few circumstances. From Park City to Paris to the dazzling islands of Turks and Caicos the worlds finest vacation destinations will become your familys playground. Determine the Equity in Your Home Calculate a Loan Payment Using Home Equity for a Purchase Were here to help 1-800-242-2265.

A home equity line of credit HELOC is another option for using home equity to purchase a. However their lines of credit. 2 REAL ESTATE EQUITY LOAN.

So if you have 100000 in home equity as in the example above you could get a home equity line of credit HELOC of 80000 to 90000. Rate and payment shown above are based on current offered rates. Get quotes from multiple contractors and to be safe add 20-30 to the total to account for potential overages.

It allows home owners to borrow against. Only an appraisal can determine the actual value of your home but some lenders may use an Automated Valuation Model AVM in their decision to determine the amount you. We can lend up to 90 of your combined loan-to-value ratio if certain qualifications are met.

Your equity helps your lender determine your loan-to-value ratio LTV which is one of the factors your lender will consider when deciding whether or not. A home equity loan is a second loan on your property. Obtaining the best rate requires the following criteria to be met.

To determine how much you may be able to borrow with a home equity loan divide your mortgages outstanding balance by the current home value. The amount of equity you have in your home impacts your finances in a number of ways it affects everything from whether you need to pay private mortgage insurance to what financing options may be available to you. When you make mortgage payments.

We determine the value of your home using our automated valuation model. Instead its a second mortgage with a separate payment. Home equity line of credit.

1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan. 3 HOME EQUITY LINE OF CREDIT. Their lines of credit are variable rate 413 as of this review and they dont involve any closing costs.

Dollar Bank representatives are available Monday - Friday from 800 AM - 800 PM and Saturday from 900 AM - 300 PM. We calculate your loan-to-value ratio by taking. To do this subtract the remaining balance of your primary mortgage from 90 of the appraised value of your home.

A home equity loan is a second loan thats separate from your mortgage and allows you to borrow against the equity in your home. Home equity is the difference between the appraised value of your home and the amount you still owe on your mortgage. Please consult a qualified tax advisor to determine if interest may be tax deductible.

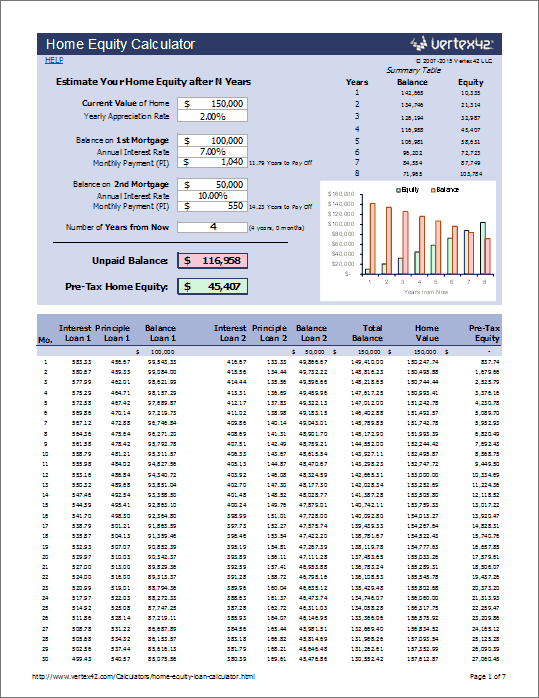

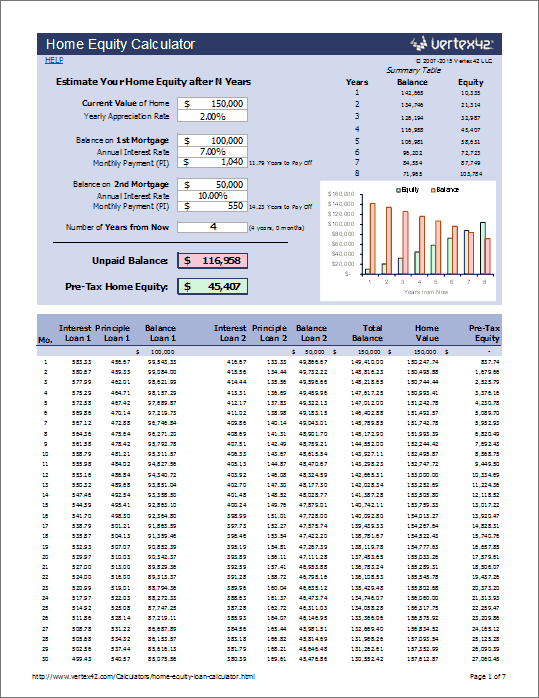

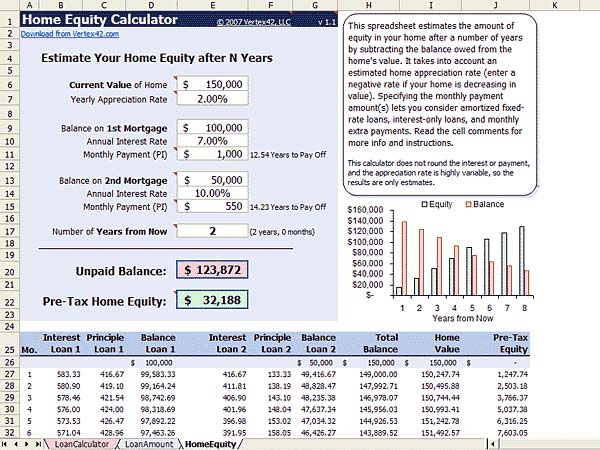

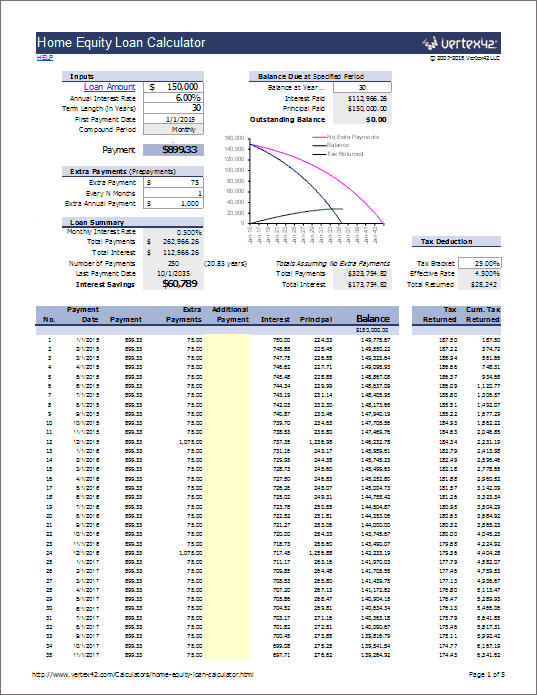

Withdraw what you need over time. Unlike stocks bonds or mutual funds Equity Estates is an investment you and your family will enjoy for years before you divest. Home Equity Calculator reveals how much equity you have today how much equity lenders will allow you to borrow and shows you when and how you can reach home equity goals.

To view Home Equity Loan rates visit our Home Equity Loans. Capital one offers very competitive rates on home equity loans and lines of credit. A home equity line of credit HELOC is a revolving line of credit that you access like a credit card.

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Calculator Free Home Equity Loan Calculator For Excel

![]()

Cash Out Refinance Vs Home Equity Loan Rocket Mortgage

Home Equity Calculator Free Home Equity Loan Calculator For Excel

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Cash Out Refinance Vs Heloc Which Equity Option Is Best Zillow

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Think Like An Appraiser To Determine What Your Home Is Really Worth Http Money Us Npm2io Smart Money Home Equity Investing

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loans Home Loans U S Bank

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Payment Calculator With Interest Only And Pi Calculations Home Improvement Loans Home Equity Loan Home Loans

Home Equity Line Of Credit Heloc Rocket Mortgage

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences